Stock Market Today Feb 20, 2026: S&P 500, Dow, Nasdaq Live Analysis

Stock Market Analysis for February 20, 2026

Current Market Overview

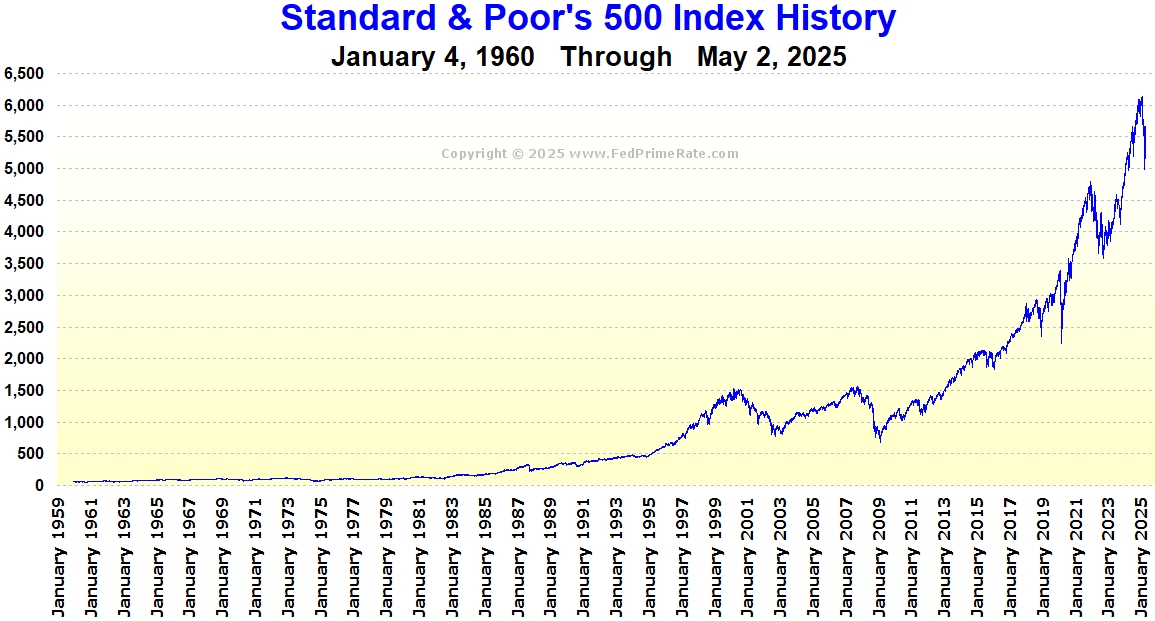

As of midday trading on February 20, 2026, U.S. stock markets are experiencing modest declines following the release of weaker-than-expected economic data. The S&P 500 is down 0.22% at 6,845.20

, the Dow Jones Industrial Average has fallen 0.26% to 49,239.60

, and the Nasdaq 100 is off 0.28% at 24,714.40

. The Russell 2000 is also lower by 0.31% at 2,654.03. In premarket trading earlier today, futures for the major indices were similarly down around 0.2% to 0.3%, reflecting investor caution amid recent economic reports.

International markets show mixed results: the FTSE 100 is up 0.24% at 10,706.40, while the Nikkei 225 closed down 0.49% at 56,813.00. Commodity prices are also in focus, with oil prices steady near six-month highs due to geopolitical tensions, gold up $66 to $5,044

, silver rising to $80.76, and Bitcoin slightly higher at $67,924

.

The broader market sentiment is cautious, with investors digesting the implications of the latest GDP figures and inflation data. The slowdown in economic growth has raised questions about the resilience of the U.S. economy, particularly in light of the recent government shutdown. Meanwhile, international equities in Asia showed caution, with the MSCI Asia index falling 0.4%, mirroring Wall Street’s declines. South Korea’s market, however, bucked the trend, rising 2% and maintaining its position as the top-performing stock market year-to-date.

Key Economic Data Driving the Market

The primary catalyst for today’s downturn is the advance estimate of fourth-quarter 2025 GDP, which came in at an annualized rate of 1.4%. This marks a significant slowdown from the 4.4% growth in the third quarter and falls well short of economists’ expectations for 2.4%. The miss has been attributed in part to a 43-day government shutdown in October and November 2025, which is estimated to have shaved about 70 basis points off growth. Full-year 2025 GDP growth was 2.2%, down from 2.4% the previous year. Despite the slowdown, economists note the economy’s resilience in 2025, bolstered by strong consumer spending and the ongoing AI boom, with potential for recovery in early 2026.

Inflation data also drew attention, with the Personal Consumption Expenditures (PCE) price index—the Federal Reserve’s preferred gauge—rising 2.9% year-over-year in December 2025, faster than anticipated. Core PCE, excluding food and energy, increased to 3% from 2.8% in November, aligning with expectations. These reports were delayed by one month due to the government shutdown. The 10-year Treasury yield edged up slightly to 4.07% following the data releases but remains down modestly year-to-date.

Other upcoming economic indicators today include manufacturing and services business activity, new home sales, and consumer sentiment surveys, which could provide further insights into the economic trajectory. The GDP disappointment has led to a reevaluation of growth prospects, with some analysts suggesting that the shutdown’s impact might linger into the first quarter of 2026. Consumer spending, which accounts for about 70% of U.S. GDP, remained robust throughout 2025, driven by wage gains and a strong labor market. However, the slowdown in Q4 raises concerns about potential softening in business investment and exports.

On the inflation front, the uptick in PCE has tempered expectations for aggressive Federal Reserve rate cuts. While the Fed has signaled a pause in rate hikes, the persistent inflation above the 2% target could prompt a more hawkish stance. Softer CPI readings earlier in the week pushed yields to multi-month lows, but the PCE data has introduced some counterbalance. Economic resilience is evident in other areas, such as strong capital goods orders and lower jobless claims, but global risks remain a concern.

Recap of Yesterday’s Close (February 19, 2026)

U.S. markets closed lower on Thursday, February 19, reversing gains from the prior session. The Dow Jones Industrial Average tumbled 0.5% (267.50 points) to 49,395.16, with 12 components advancing and 18 declining. The Nasdaq Composite slid 0.3% to 22,682.73, pressured by weakness in software stocks. The S&P 500 fell 0.2% to 6,861.89, though seven of its 11 sectors ended in positive territory.

Sector performances were mixed: Energy (XLE) rose 1.9% and Technology (XLK) gained 1%, while Utilities (XLU) dropped 1.7% and Real Estate (XLRE) fell 1.3%. The CBOE Volatility Index (VIX) increased 3.1% to 20.23, signaling heightened market uncertainty. Trading volume was 16.4 billion shares, below the 20-session average of 20.5 billion. The S&P 500 saw 27 new 52-week highs and six new lows, while the Nasdaq recorded 62 highs and 146 lows.

Concerns over private credit providers weighed on sentiment, with Blue Owl Capital Inc. (OWL) selling $1.4 billion in loan assets and halting redemptions in one of its funds. Shares of OWL plunged 5.9%, Blackstone Inc. (BX) fell 5.3%, and Apollo Global Management Inc. (APO) dropped 5.2%. Geopolitical tensions between the U.S. and Iran also escalated, with President Trump indicating a potential military decision within 10 days, pushing crude oil prices up about 2%.

Economic releases from yesterday included initial jobless claims dropping 23,000 to 206,000 (better than the expected 221,000), continuing claims rising to 1.869 million, and a trade deficit surging to $70.3 billion (far above the $58.4 billion forecast). The Philadelphia Fed Index rose to 16.3 (beating estimates), pending home sales dipped 0.8% month-over-month, crude oil inventories fell 9.0 million barrels, and leading indicators decreased 0.2%.

The selloff in financials and geopolitical concerns have kept investors on edge, with the S&P 500 testing horizontal resistance at 6900 earlier in the week before retreating. A slight negative skew persists, with highs around 7,000 and lower lows since the year began, suggesting potential downside to 6730.

Sector Breakdown

Diving deeper into sectors, energy stocks have been a standout performer amid rising oil prices. The XLE’s 1.9% gain yesterday reflects the sector’s sensitivity to geopolitical events, particularly the U.S.-Iran tensions. Technology, despite broader Nasdaq weakness, saw gains in select areas, driven by AI-related optimism. However, software stocks dragged the index lower.

Financials faced significant pressure due to private credit issues. The liquidation at Blue Owl and redemption halts highlight liquidity concerns in the $1.7 trillion private credit market, which has grown rapidly post-2008. This could signal broader vulnerabilities if economic slowdown persists.

Utilities and real estate declined amid rising yields and inflation data, as these sectors are interest-rate sensitive. On the positive side, consumer discretionary and industrials showed resilience, supported by strong jobless claims data.

Internationally, European markets like the FTSE 100 edged higher, while Asian markets were mixed. In India, the Sensex closed up 316 points at 82,814.71, led by bank stocks, with Nifty at 25,571.25. Twelve of 16 major sectors in India logged weekly gains, though small-caps fell 0.2%.

Notable Stock Movements

Key movers include Opendoor Technologies, soaring after better-than-expected results in online real estate. Applovin shares rose amid reports of building a social media network.

In tech, Microsoft received a buy reiteration from Citigroup, citing decade-low valuations.

Broadcom and CoreWeave also garnered positive analyst notes.

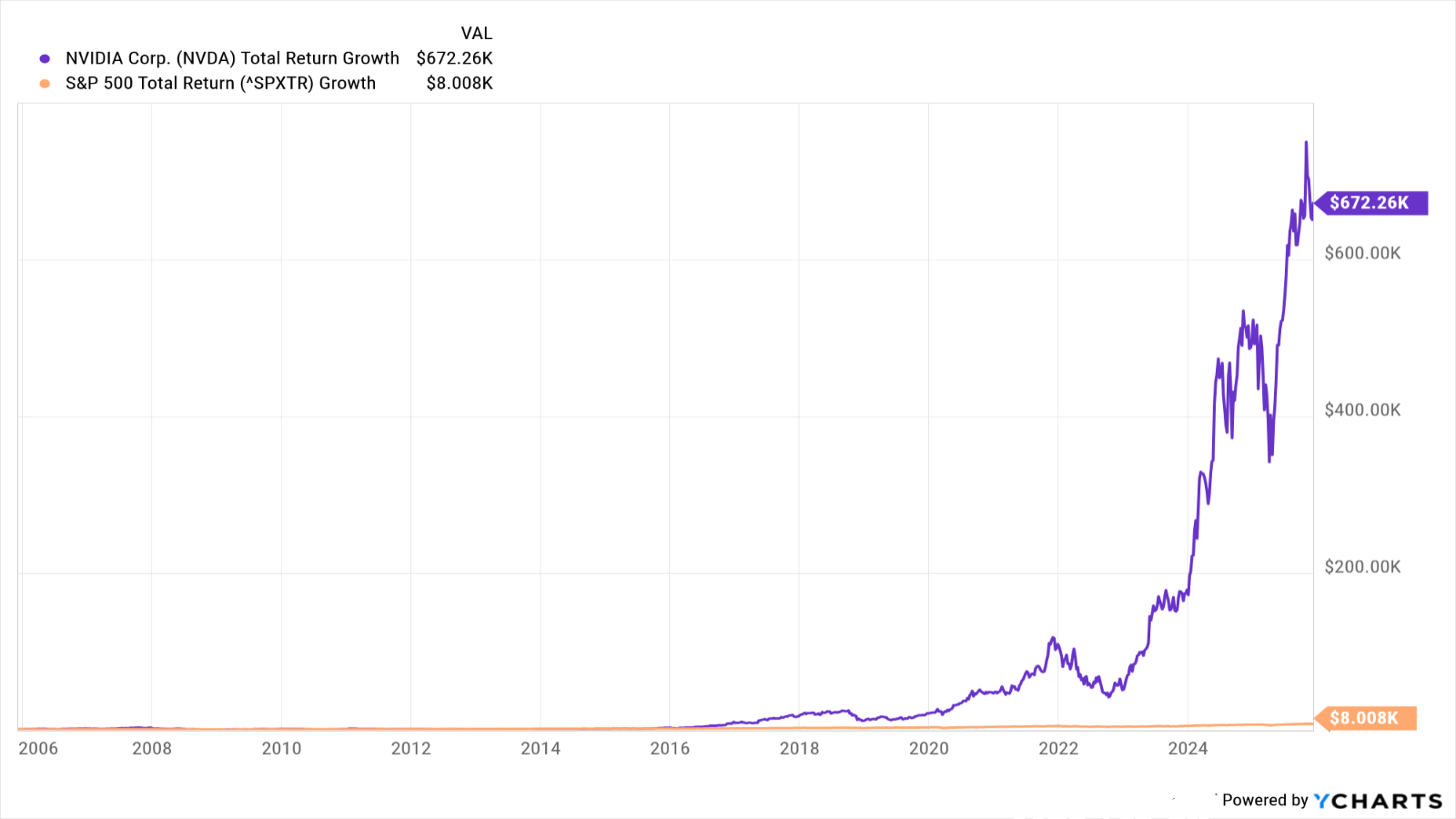

Nvidia remains a focal point, with shares up modestly YTD but far from last year’s 1,500% surge.

Upcoming earnings are critical, with demand for its Blackwell platform described as “off the charts.” Other Magnificent Seven stocks like Microsoft and Amazon are down 17% and 11% YTD, respectively.

In healthcare, AstraZeneca’s Calquence combo was approved in the US for chronic lymphocytic leukemia.

Global Market Influences

Geopolitical risks, including U.S.-Iran tensions, have pushed oil to six-month highs, impacting energy stocks positively but adding volatility. President Trump’s comments on a potential military decision have heightened uncertainty.

Trade concerns persist, with the U.S. trade deficit surging to $70.3 billion. International stocks outperformed in January, with developed and emerging markets rising amid U.S. policy worries.

In early 2026, markets show mixed signals: new highs but volatility from tariffs and inflation. The S&P 500 briefly crossed 7,000 but dropped on tariff threats.

Analyst Insights and Forward-Looking Commentary

Analysts remain optimistic on select tech stocks amid the broader pullback. Citigroup reiterated a buy rating on Microsoft, highlighting its decade-low valuations and discount to the S&P 500 on forward P/E. Goldman Sachs maintained a buy on Broadcom ahead of next week’s earnings, while Morgan Stanley kept an equal weight on CoreWeave, citing needs for milestones like increased data center capacity.

Nvidia’s upcoming earnings are in the spotlight, with Citi reiterating a buy due to its AI leadership and attractive valuations. Demand for Nvidia’s Blackwell platform is described as “off the charts,” with focus shifting to the Rubin architecture for 2026-2027.

Gold analysts are bullish, projecting prices to reach $7,000 to $10,000 driven by geopolitical risks, high deficits, central bank demand, a weaker U.S. dollar, and potential Fed rate cuts.

For broader markets, the interest rate outlook will be scrutinized next week with more earnings and jobs data. Energy stocks are ones to watch amid major developments.

In India, recommendations include IndusInd Bank and UPL for a 3-month horizon, with Nifty showing bearish signals below 25,500-26,000.

Risks and Opportunities

Key risks include escalating geopolitical tensions, persistent inflation, and private credit vulnerabilities. A downside resolution for the S&P 500 to 6730 remains possible during seasonal weakness. Trimming equity exposure is prudent until resolved.

Opportunities lie in pro-cyclical and commodity-oriented themes, which have flourished this year. AI-driven tech stocks like Nvidia and Microsoft offer long-term potential, despite YTD underperformance.

Overall, markets are navigating a mix of economic slowdown signals and persistent inflation, with geopolitical risks adding volatility. Investors are watching for further data and corporate earnings to gauge the path forward. The coming week features Nvidia’s report, retail results, and the State of the Union, which could influence sentiment. With U.S. stocks near records but jittery, a balanced approach focusing on resilient sectors is advisable.